Bitcoin Could Change The Derivatives Market, Says UBS Banker

Bitcoin could change derivatives, in particular settlement, trading and securities issuance according to some individuals, among whom are bankers and technologists. Alex Batlin, who has been a vocal supporter of banks adopting Bitcoin related technologies, told attendees of the IDX Derivatives Expo in London that blockchain technologies will change banking.

Bitcoin could change derivatives, in particular settlement, trading and securities issuance according to some individuals, among whom are bankers and technologists. Alex Batlin, who has been a vocal supporter of banks adopting Bitcoin related technologies, told attendees of the IDX Derivatives Expo in London that blockchain technologies will change banking.

“Blockchain technologies can make banks more efficient – for example through instantaneous settlement rather than the days it takes at present, lower costs and lower operational risk,” according to Alex Batlin , chief technology officer for innovation at UBS.

The simple lesson for banks is that if we don’t do it someone else will. The key attraction is that there is no middle or back office, and no registry, so clearly a major impact on costs.

“Utilising the blockchain is a natural digital evolution for managing physical securities,” claims Nasdaq CEO Bob Greifeld. “Once you cut the apron strings of need for the physical, the opportunities we can envision blockchain providing stand to benefit not only our clients, but the broader global capital markets.”

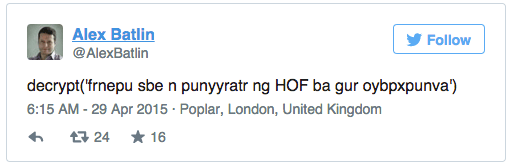

“All kinds of revenue opportunities can emerge, but it’s still more expensive, so there is a way to go,” said Batlin. Batlin in April tweeted in cryptography, “search for a challenge at UBS on the blockchain.”

Batlin is not the first UBS executive to speak positively of Bitcoin. Oswald Gruebel was head of Credit Suisse for four years and took over at USB AG in 2009, resigning in 2011. As CCN.com reported:

The only investment that has been proven holds its value over a longer period, gold, and in the future (Bitcoins). Gold and Bitcoins production is limited. Not so with money. Central banks can print unlimited money and tell us today also very clear. It is for this reason not recoverable.

You should not rely on The State itself. Maybe he paid you in the future is not what you imagine today. Everyone should take the initiative. When you create, you must find something that is limited and not increased arbitrarily.

In April, it was announced UBS would launch Open Blockchain Research Lab in London. In October 2014, Oliver Bussmann, group chief information officer at UBS, said the block chain had the potential “not only change the way we do payments but it will change the whole trading and settlement topic.” UBS concluded that the underlying Bitcoin technology could be used to improve global payment systems.

Setting aside its political agenda, we see Bitcoin as having some potential as a new transaction technology, where a bitcoin-like technology could provide a basis for a new shared payments and transfer system using existing currencies and securities. Such a system could reduce systemic costs, and provide faster, secure, transfers – particularly in the international arena.