Tezos Derivatives Crashes Amid Management Infighting after $232 Million ICO

The price of Tezos derivatives has crashed on multiple exchanges following the revelation of infighting between the platform’s developers and the independently-operated Tezos Foundation.

Infighting at Tezos

Initial coin offerings (ICOs) have exploded in 2017, and the Tezos ICO rode that wave to a then-record $232 million ICO in July. According to some estimates, that stockpile has appreciated to $400 million as a result of the crypto market’s rising tide, meaning that Tezos should be positioned to devote unprecedented resources to the development of its “self-amending cryptographic ledger”.

However, as an investigation by Reuters reveals, this mammoth crypto war chest could not prevent management infighting from derailing the project — and it may have even contributed to the problem.

According to Reuters, Tezos management is rife with infighting. The platform’s inventors, Arthur and Kathleen Breitman, founded a company that develops — and owns — the Tezos code, as well as all associated intellectual property. However, they set up an independent Swiss foundation to manage the ICO and maintain the funds, the plan being that the foundation would eventually purchase the company from the Breitmans and their other shareholder — venture capitalist Tim Draper — for approximately $20 million. This is in addition to the 10% stake the shareholders will receive from the total supply of “tezzies”.

Somewhere along the line, relations soured between the Breitmans and Johann Gevers, the foundation’s president. In a blog post , the Breitmans accused Gevers of “self-dealing”, while

Gevers told The Wall Street Journal that the Breitmans had “attempted to bypass the Swiss legal structure and take over control of the foundation.” He blames them for “causing months of delays in the Tezos project.” The Journal also reports that a lawyer for the Breitmans sent a letter to the foundation threatening to withdraw their support from the project unless Gevers was removed from its board.

This infighting has stunted the development of the Tezos network. Prior to the ICO, contributors were told that the target date for the release of the Tezos network was mid-November, but that has now been pushed back to at least February 2018.

Tezzie Futures Crash

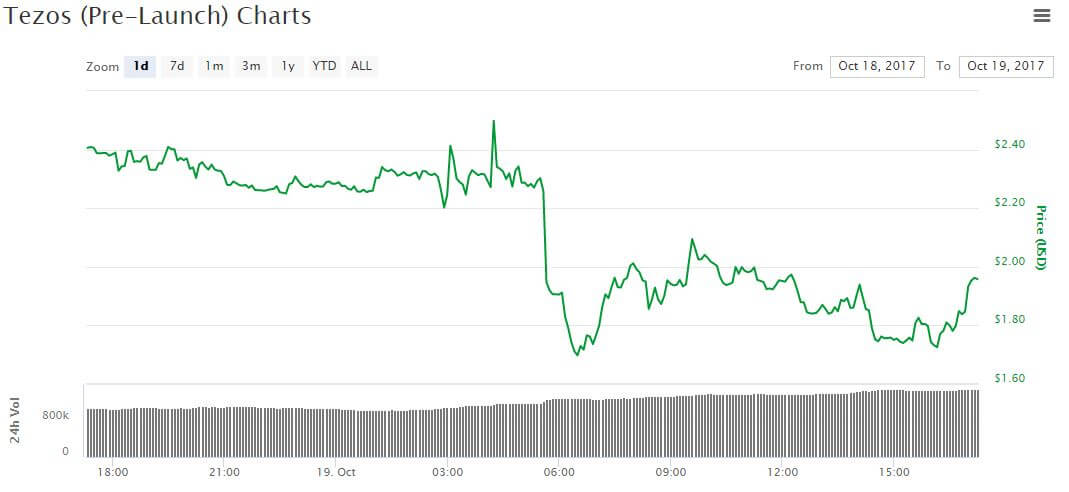

Although tezzies have not been released to contributors, several exchanges have enabled futures markets for the token — and the price is crashing. Following the release of the Reuters report, the tezzie derivatives offered by HitBTC crashed from $2.30 to $1.70 in an hour, and although they have since ticked up to $1.98, they are still down more than 20% for the day.

On BitMEX, where tezzie futures contracts expire at the end of December if the network has not been launched, the price has plummeted about 50% in the past day.

“People had no idea what was going on in Tezos,” BitMEX chief executive Arthur Hayes told Bloomberg . “There’s a lot of public information on what’s going on with a project, but most people are too lazy to do any real homework.”

Tezos did not immediately respond to a quest for comment.

Featured image from Shutterstock.