Bitcoin Cash Hashrate Plunges as Price, Mining Profitability Wane

The bitcoin cash hashrate has plunged over the past week, falling to just 5% of the main blockchain’s hashrate. As a result, block distribution is increasingly becoming centralized.

Bitcoin Cash Hashrate Falls to 440 PH/s

Bitcoin miners are in a unique position in that they can seamlessly move between the BTC and BCH blockchains to mine the most profitable coin. This has created wild fluctuations in the bitcoin cash hashrate because the network difficulty adjusts more often than the main blockchain. When the network launched following the user-activated hard fork (UAHF) on August 1, bitcoin was far more profitable to mine, so the miners who switched over to BCH did so for reasons other than immediate financial gain.

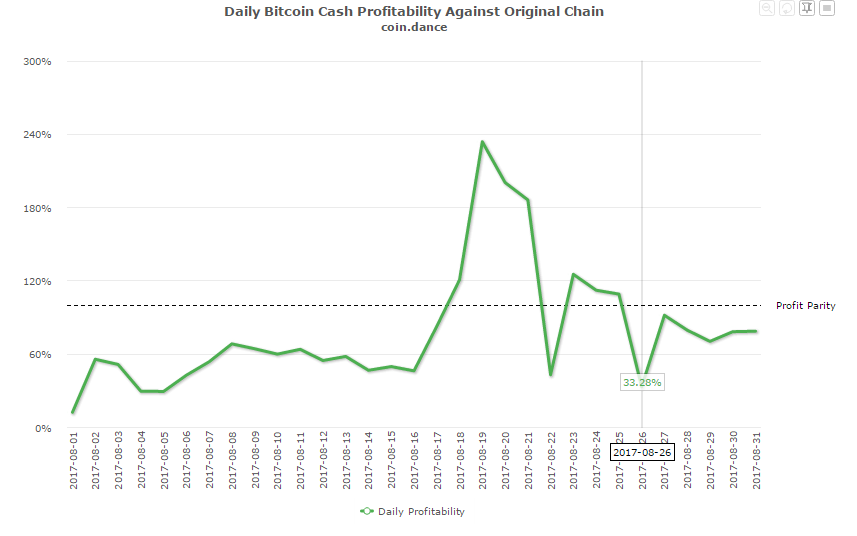

Two weeks later, the bitcoin cash price began to climb as a network difficulty adjustment neared. Difficulty was dramatically reduced following the adjustment, and suddenly hashpower began pouring into the bitcoin cash network. At its peak on August 18, bitcoin cash was 234% as profitable to mine as the main blockchain, and on August 22, the bitcoin cash hashrate actually surpassed bitcoin for a few hours.

However, this flood of hashpower led to blocks being found almost every minute, triggering a difficulty adjustment that caused profitability to plummet and miners to abandon the network. Despite a brief journey back to parity, bitcoin has remained the more profitable blockchain for the majority of the past week. At present, bitcoin is 27% more profitable to mine, and the bitcoin cash hashrate has evaporated to 440 PH/s–just 5% of the combined BTC/BCH total.

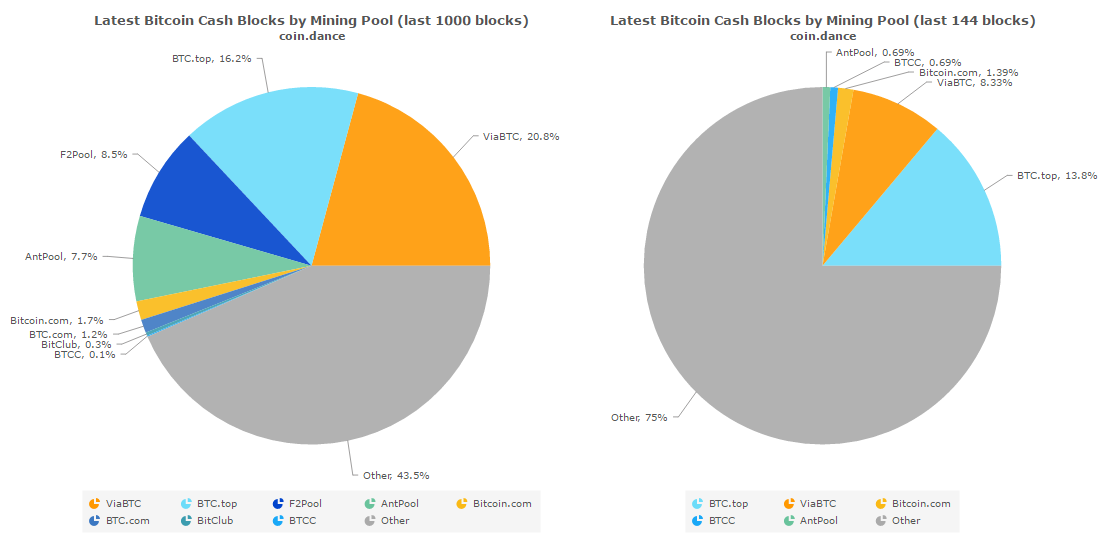

This reduced hashpower is rapidly centralizing the bitcoin cash hashrate, which in theory makes bitcoin cash more vulnerable to a 51% attack. As this block distribution chart from Coin Dance demonstrates, F2Pool, ViaBTC, and AntPool have significantly reduced the hashpower they are directing at the BCH network, enabling an unknown miner or group of miners to find 75% of the last 144 blocks. On the main bitcoin blockchain, for reference, no single pool has found more than 17% of the blocks mined in the last week.

Featured image from Shutterstock.