Bitcoin Price Hits New-All Time High at $6,151, Market Gains Confidence

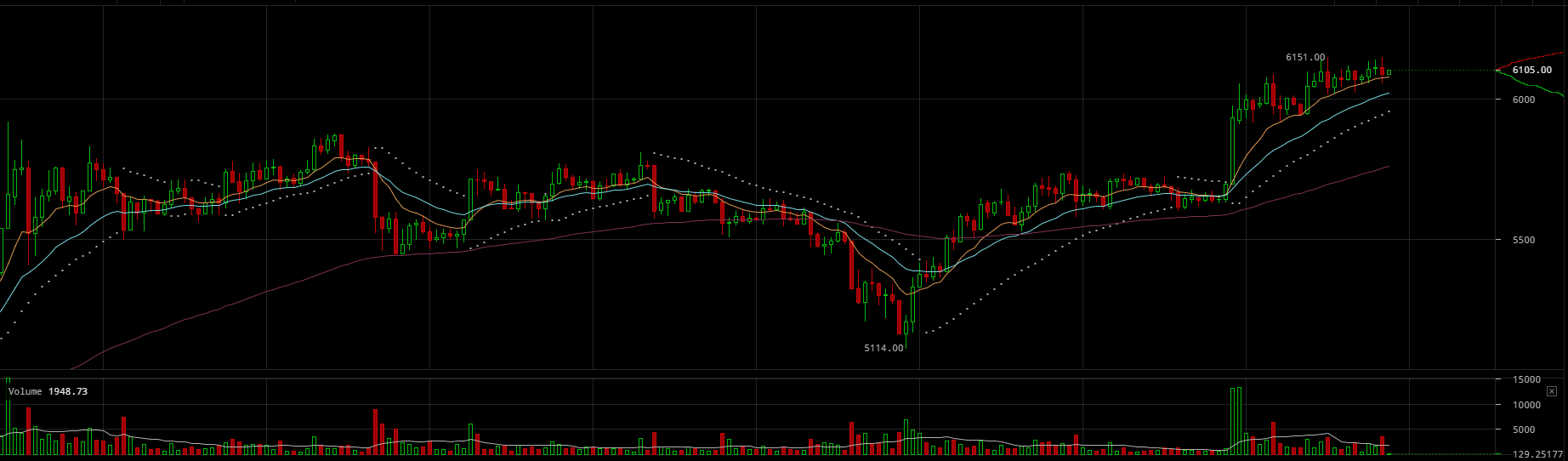

After recording a meteoric rise in value from $5,700 to $6,052, the Bitcoin price has established a new all-time high for the second time this week, at $6,151.

Within the past 12 hours, the Bitcoin price has slightly corrected to $6,105. Optimistically, the Bitcoin market has demonstrated stability throughout the day, as the Bitcoin price remained relatively stable in the $6,105 region for nearly 13 hours.

Market Gains Confidence Over Bitcoin’s Mid-Term Growth

On October 20, CCN.com reported that the demand for Bitcoin major markets such as the US and Japan have increased rapidly due to the entrance of institutional and retail traders. Specifically, the US market has started to anticipate the launch of Bitcoin exchange-traded funds (ETFs) in the upcoming months, which were rejected in March.

As CoinCenter Executive Director Jerry Brito explained at the time, the US Securities and Exchange Commission rejected the ETF application of the Winklevoss twins, citing lack of regulations in overseas markets. Brito stated:

“The Winklevoss ETF proposal was rejected because the SEC found that the significant markets for Bitcoin tend to be unregulated overseas markets that are potentially subject to price manipulation. But this creates a chicken and egg problem. How do we develop well-capitalized and regulated markets in the US and Europe if financial innovators aren’t allowed to bring products to market that grow domestic demand for digital currencies like Bitcoin?”

However, since then, overseas Bitcoin market such as Japan and South Korea have significantly matured, with more efficient and practical regulatory frameworks imposed by the two governments. The Financial Services Agency (FSA) of Japan has especially focused on providing a transparent and fair market for both businesses and investors, creating a national licensing program for cryptocurrency exchange.

Hence, the SEC’s concern in regards to the depth of the Bitcoin market and the lack of regulations on overseas cryptocurrency markets is a non-issue, and analysts have started to suggest the strong probability of Bitcoin ETFs being approved at least by early 2018.

Criticism From Naysayers and Public Figures Good For Bitcoin: Analyst

More to that, prominent investors such as Ari Paul, the co-founder at Blocktower Capital, a cryptocurrency hedge fund established by former Goldman Sachs Vice President Matthew Goetz, emphasized that the baseless criticism on Bitcoin by public figures such as JPMorgan CEO Jamie Dimon have brought more attention to Bitcoin and the JPMorgan market, which is important for a market like Bitcoin that is still at its early stage. Paul stated:

“One reason for the current Bitcoin rally: naysaying by Dimon, El-Arian, Shiller etc. Less than 1% of Americans own BTC. Of the small number of current BTC holders, very few sell on the statements of naysayers. But those naysayers bring general attention. If the naysayers introduce 1 million people to BTC who were previously unaware, and just 5% end up buying, it’s hugely bullish. ‘All attention is good attention’ when you’re so early on the adoption curve.

Also, it is important to acknowledge that many analysts have suggested the strong probability of cryptocurrency trading resumption in China after the reelection of current Chinese President Xi Jinping, who has been an advocate for free markets. Already, the Chinese government and its state-owned news publication Caixin have hinted the possibility of introducing national licensing program for Bitcoin and cryptocurrency exchanges.

Featured image from Shutterstock.