Bitcoin Unlimited Surpasses 30% of the Network’s Share

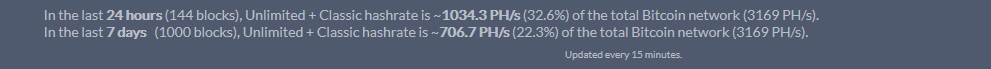

In a surprising move, the network’s share of Bitcoin Unlimited jumped by more than 10% in the past 24 hours, rising from around 20% to more than 30%, the highest any alternative client has ever achieved.

The significant increase coincides with the sudden arrival of 100 Bitcoin Unlimited nodes earlier this week. Although there were suggestions these nodes are fake, it now appears more likely that someone, probably a miner, has switched to Bitcoin Unlimited.

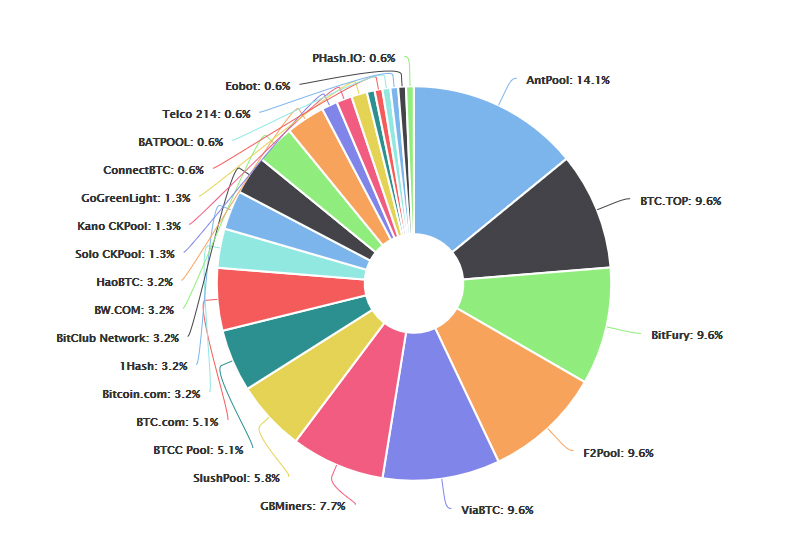

A new pool has indeed joined with a small amount of hashrate, the Canoe pool. They appear to have left BW.com, which has seemingly lost hashrate, but we cannot currently confirm.

Another miner is meant to leave BW.com. Chandler Guo has stated he will take out his hashrate form BW.com to form his own pool which will mine with Bitcoin Unlimited, but they have not yet mined any BU block.

BU’s hashrate share over the past 24 hours could be just variance, but the significant jump suggests that might be unlikely. All BU pools seem to have gained in hashrate share. Most notably, GBMiners have been gradually rising over the past 4 days, now standing at 7.7% of the network’s share in the past 24 hours.

If BU maintains its current distribution, its activation becomes a real consideration. As Guo’s pool is soon to launch, it may near 35% or perhaps even 40%, a hairbreadth’s away from attitudes changing towards considering it a foregone conclusion.

Have Miners Decided?

Can it really happen? – many are asking. After almost two years of debate, it is difficult to say, but something very interesting is happening. People are leaving their jobs or established pools to enter the mining market. All of them mine with BU. They are calling Bitcoin Core bluff.

It is what theory suggests. Concentration of hashrate is usually not a problem because the mining market is open and permissionless. Where they misbehave, whether objectively or subjectively, theory suggests the market would punish them by incentivizing new miners to enter which means the hashrate of old miners goes down. The new miners, in turn, in trying to get market share, give the market what it wants.

We have seen this before. The market’s response to GHash gaining more than 50% of the network’s share just over only two years ago, was to send them off the hashrate share chart completely.

The current situation is somewhat different. Objectively, there is a serious problem as fees are increasing exponentially while transactions are becoming slow, unpredictable and a frustrating experience. How to solve that in the long term isn’t too obvious.

Bitcoin Core believes there should be bitbanks, an idea developed before Nakamoto announced bitcoin and seems to be the prevalent thinking at the time. That is, the public blockchain should be reserved for bitbanks through which everyone transactions on a protocol built on top of bitcoin called the Lightning Network (LN).

The problem is LN remains in a very alpha state, has never been tried or tested and no one really knows what the actual user experience would be or whether anyone would want to use bitcoin through LN, which may mean they are forced to leave to other digital currencies.

Furthermore, Nakamoto rejected the bitbanks argument even though it was made to him numerous times, including during the first response to his white paper announcement. Eventually, he became too frustrated by the suggestion and simply concluded by stating “If you don’t believe me or don’t get it, I don’t have time to try to convince you.”

Objectively, it appears reasonable for capacity to be increased through a simple maxblocksize raise, which instantly solves the problem, while we wait for LN to be launched in a beta fashion as well as tried and judged by the market.

However, some Bitcoin Core developers insist that fees should be high and everyone should just transact on LN as soon as it is launched. Developers that disagreed have had their commits removed.

A suggestion Bitcoin Core has made, segregated witnesses (segwit) – a slow one off transaction capacity increase to around 1.7MB from the current 1MB – appeared to be a done deal at one point late last year, but it has stalled at around 23% for months.

Bitcoin Core seems to have no intention towards making any other suggestion for a transaction capacity increase, leaving miners with one final decision: whether to adopt Bitcoin Unlimited or otherwise.

The new grassroots client increases transaction capacity in the same way bitcoin has for much of its existence. Despite apparent objections by Peter Todd and Luke-Jr, miners increased capacity in a decentralized fashion from 250kb to 500kb in March 2013. Then to 750kb and thereafter to 1MB.

Bitcoin Unlimited turns this 1MB limit into a soft limit, allowing miners to increase it in a decentralized manner to 2MB in line with demand, the progress of technology and their own reasonable judgement.

It is a long-term solution which takes into account the unpredictable nature of the future. A solution that now appears to be gaining momentum as miners seemingly finally move towards making a conclusive decision on this matter.

Disclaimer: The views expressed in the article are solely that of the author and do not represent those of, nor should they be attributed to CCN.com.

Images from Shutterstock.