Coinbase’s CEO Calls for Segwit Activation

Brian Armstrong, CEO and co-founder of Coinbase, has called for the activation of segwit, a controversial protocol update of the bitcoin network which adds further transaction capacity while largely fixing transaction malleability to pave the way for the Lightning Network.

Armstrong stated segwit is “prob[ably] the best path forward for bitcoin at this point,” before calling on everyone to “come together and move forward as an industry. Activating SegWit can help us get there and it has a number of good features.”

His statement was in reply to Charlie Lee, Litecoin’s founder and Director of Engineering at Coinbase who publicly asked to “activate SegWit! Maybe not the full scaling solution you want, but it does a ton of good stuff today and enables lightning networks.”

Washington Sanchez, Co-founder of Open Bazzar, an e-Bay like bitcoin market, stated Armstrong’s changed stance was “disappointing,” but few will find the shifting attitude as surprising.

After almost two years of heated debate on how to increase bitcoin’s transaction capacity, no proposal has yet been adopted, with most losing interest on how the matter is resolved while fees increase to an average of $0.47 cent per transaction and a median fee of $0.22 due to lack of transaction space.

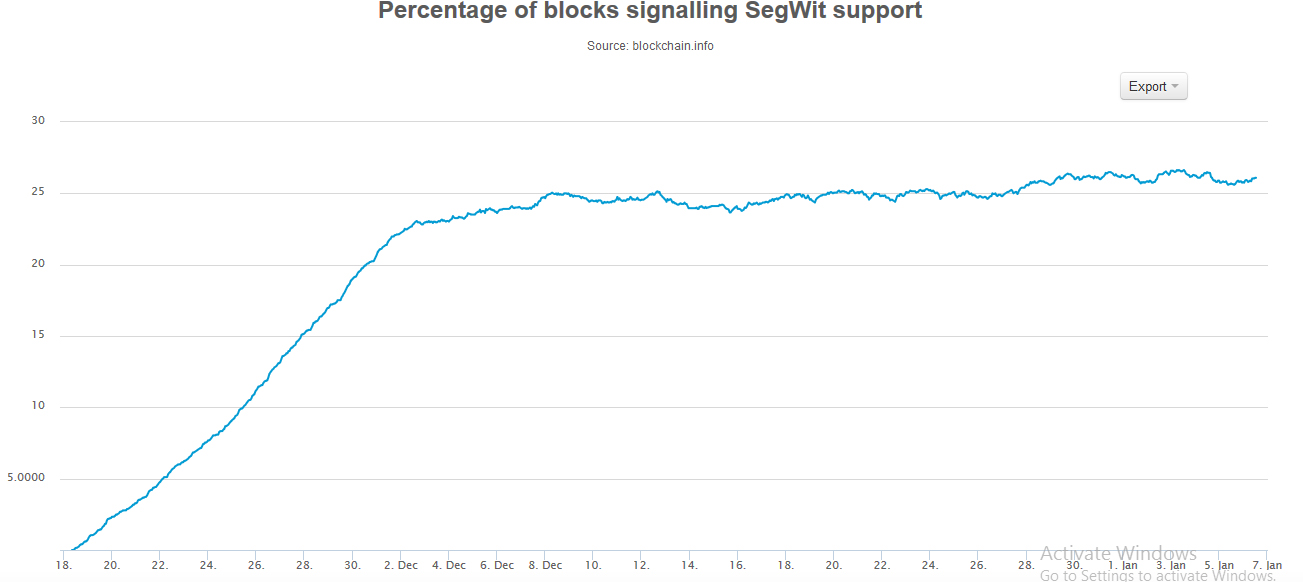

The two proposals on the table – Bitcoin Unlimited, which immediately increases capacity if activated through a hardfork – and segwit, a softfork capacity increase, have seemingly divided miners and the wider community, leading to a stalemate. BU currently stands at around 15% of the network’s hashrate, while segwit has stalled at around 25%.

A Re-United Community?

Armstrong was one of the strongest supporter of prioritizing on-chain scaling, vocally advocating for Bitcoin Classic in early 2016, but as that proposal was rejected by miners, Coinbase’s co-founder began embracing Ethereum which has plans for unlimited on-chain scalability through sharding.

Since then, Armstrong has been fairly quiet on the scalability question, with Roger Ver becoming the most vocal and active supporter of Bitcoin Unlimited, but the client has found support of only 15% of the hashrate, with little changing for some months. On the other hand, Haipo Yang, ViaBTC’s founder, which currently controls almost 6% of the network’s hashrate, has strongly opposed segwit, raising doubts on whether it can reach the needed 95% threshold for activation, leading to a stalemate.

“It doesn’t matter,” said John McAfee back in November, a former programmer for NASA during the 70s and creator of the first anti-virus, whether the blocksize is increased or segwit is activated, suggesting either would provide transaction capacity, but questions remain on whether the community would be able to move forward as one if segwit is activated. Primarily because Michael Marquardt, better known as Theymos, the top moderator of r/bitcoin, one of the main public forums for bitcoin discussion, has instituted a policy of censorship and tight control, preventing any common understanding and exchanging of ideas.

Moreover, questions remain on whether miners are willing to increase capacity considering the added income from fees. They have failed to make any decision, despite four proposals being suggested, raising concerns they may not activate any increase at all.

The Bitcoin Approach vs The Eth Approach

If segwit is activated, bitcoin and ethereum will differ fundamentally on how they approach scalability, at least in the short term. Gradually, bitcoin is planned to become more and more expensive for on-chain transactions if demand continues to increase, with most transactions to be through the Lightning Network, a new, yet to be launched protocol built on top of bitcoin which aims to use the public blockchain mainly for batched settlement transactions. While Ethereum aims to provide sufficient on-chain capacity to keep fees low.

The difference between the two approaches depends mainly on how Lightning will operate in practice. If it is as convenient, secure, private, censorship-resistant, permissionless, and cheap as on-chain transactions, then few may care, but if it adds any extra steps or hubs begin censoring or begin losing money or requiring identification, then bitcoin and ethereum will become fundamentally different.

Comparing the two, Armstrong stated in a recent public post , that bitcoin has not become “a scalable payment network.” As such “an opportunity has emerged for other protocols to fill the payment network gap. Ethereum seems the most likely candidate for this at the moment.”

The idea seems to be that bitcoin is a commodity comparable to digital gold, while Eth acts as a currency and performs the function of digital cash. However, fundamentally, both are very much similar, with both having the ability of being digital gold and digital cash at the same time. The question is one of convenience and competitiveness regarding fees if and once segwit is activated. If it is found to be inconvenient, then either bitcoin will correct course or alternatives will rise.

In many ways, therefore, as the market will likely be provided both approaches, whether segwit or BU is activated doesn’t greatly matter as eventually we will realize the best approach to this ancient debate by studying empirical data. As BU seems unlikely to gain support from some active bitcoin developers, activating segwit is probably the best approach at this point.

But, the public forums censorship – contrary to all principles of bitcoin – regardless of how miners will now act, if they will act at all, remains an unsolved problem.

Image from Shutterstock.