Ethereum, Bitcoin Prices Lead $20 Billion Slump Amid Chinese Regulatory Turbulence

This week was a turbulent one for the crypto markets, with the total cryptocurrency market cap shedding $20 billion amid Chinese regulatory uncertainty. The bitcoin price ended the week with an 8% decline, while the ethereum price posted a double-digit dip. Leading into Saturday, 96 of the top 100 cryptocurrencies experienced single-day retreats, although the past hour shows signs of a possible recovery.

The reason for this pullback was Friday’s rumored China bitcoin ban. According to a regional news source, China planned to follow up Monday’s initial coin offering (ICO) ban by declaring it illegal to operate a cryptocurrency exchange. The report was not confirmed by official sources, but it spooked traders, sending the markets careening downwards in a flash crash. Within minutes, the total crypto market cap fell from $164.2 billion to $146.5 billion.

Eventually, regional cryptocurrency news source cnLedger succeeded in contacting OKCoin, BTCC, and Huobi–three of the country’s largest bitcoin exchanges–each of whom denied that they had received shutdown orders from the government and thus continued to operate normally. That halted the market free-fall, but the total value of all cryptocurrencies remained below $150 billion at the time of writing.

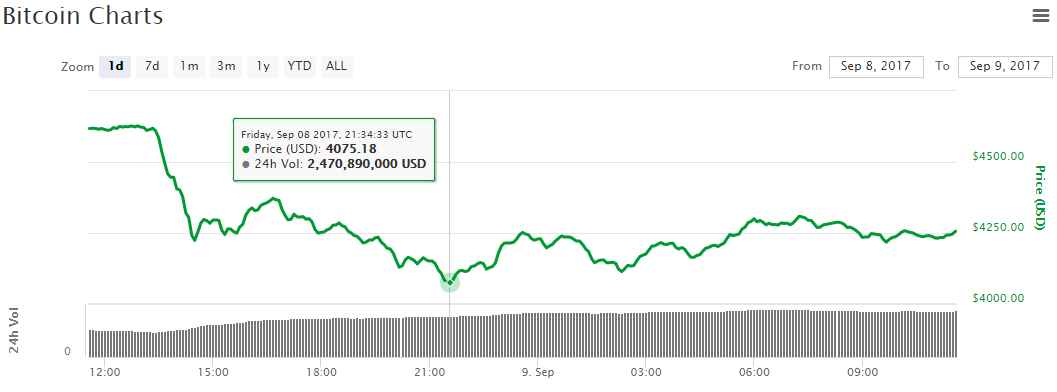

Bitcoin Price Plunges $400 in 10 Minutes

When the rumors that China would ban bitcoin exchanges surfaced on Friday, the bitcoin price went into a tailspin. Bitcoin fell $400 in 10 minutes, and on Chinese exchanges, it dropped well below $4,000. At its low-point, the bitcoin price dipped to a global average of $4,075–exactly $900 below the all-time high it set just over a week ago. At present, the bitcoin price is $4,260, representing a daily and weekly decline of about 8%. Bitcoin now has a market cap of $70.5 billion.

But although the bitcoin price’s weekly performance might disappoint some investors–especially those who just recently entered the community–it’s important to put it in context. First, the bitcoin price is still up about $1,000 from where it was last month at this time; this is a remarkable run. Second, the bitcoin price has endured rumors of two major cryptocurrency squeezes (one confirmed, one not) from the world’s largest nation but has maintained a global average above $4,000. This demonstrates significant resiliency.

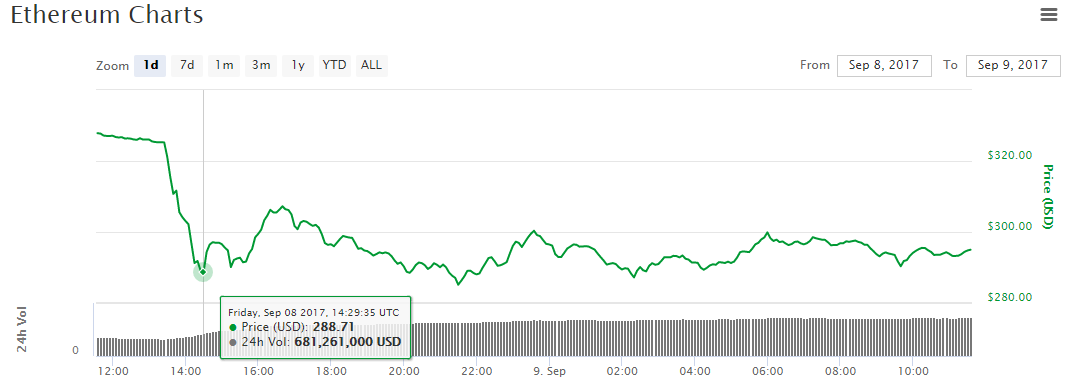

Ethereum Price Drops Below $300 Ahead of Metropolis Hard Fork

China’s ICO ban affects ethereum more directly than bitcoin, so it’s not surprising that the news hit the ethereum price harder than bitcoin. The ethereum price posted a 7-day decline of 16%, pushing it below $300 to a present value of $296. Ethereum now has a market cap of just under $28 billion.

That said, the first phase of ethereum’s next protocol upgrade, Metropolis, will begin later this month, and many analysts expect this will lead to a bump in the ethereum price.

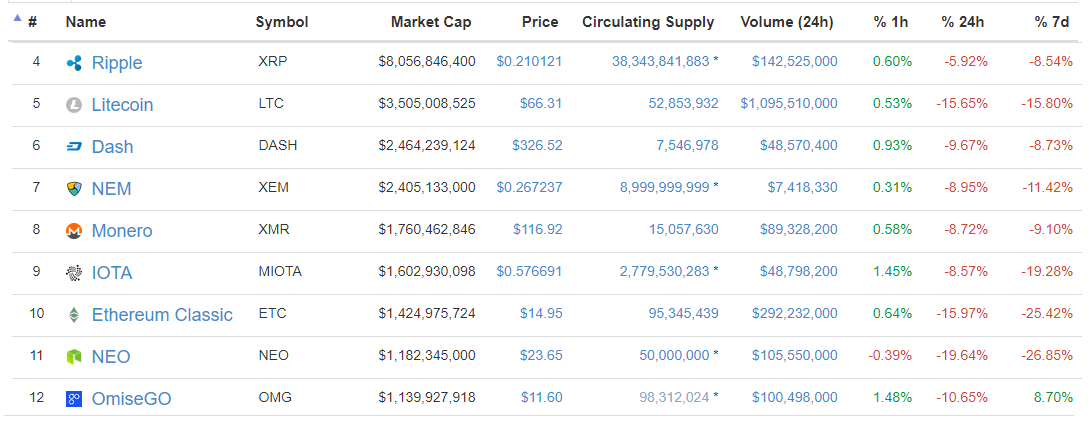

Altcoins Struggle Amid Market Uncertainty

Few major coins made positive movement this week. The most prominent was 12th-place OmiseGO, which managed to rise 9% for the week despite a 24-hour decline of 11%. Elsewhere, the charts are mostly characterized by a monochromatic red hue.

The bitcoin cash price ended the week with a 5% drop after nearly touching $700 a few days ago. The Ripple, Dash, and Monero prices dropped 9%, while other top 10 coins fared even worse.

The litecoin price dropped 16%, with most of that movement occurring within the past day. The NEM price fell 11%, while IOTA plunged by 20%. Ethereum classic and NEO–ranked 10th and 11th–each plummeted by more than one-quarter, dropping to $15 and $24, respectively.

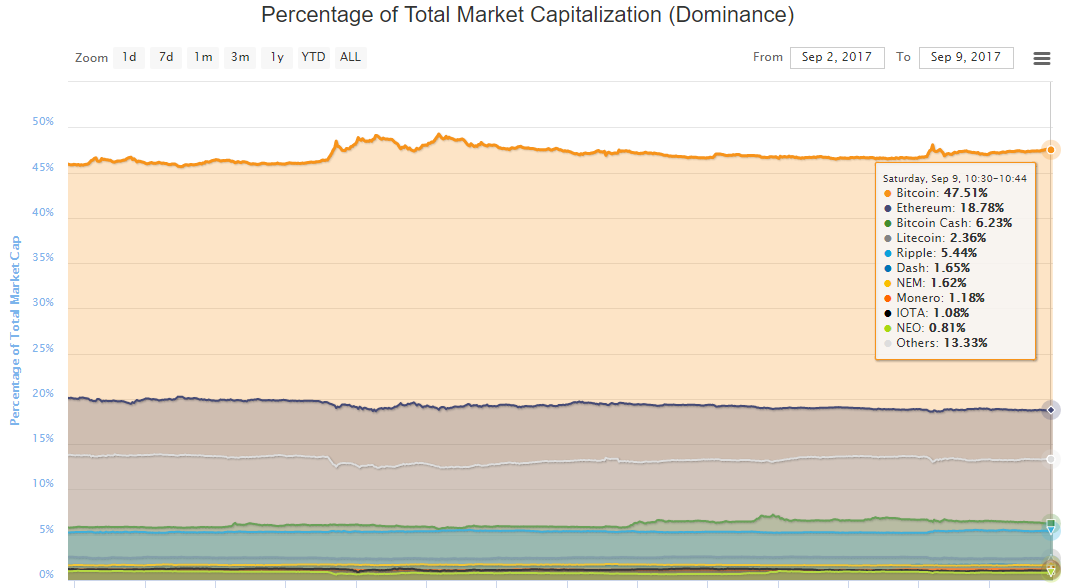

Bitcoin Consolidates Market Share

As is generally the case, this week’s market pullback led to an increase in bitcoin’s market share. After beginning the week with a 46% slice of the market, bitcoin now accounts for 47.5% of the total value of all cryptocurrencies. Ethereum, which generally controls a 20% share, saw its hold on the market slip below 19%.

One other major cryptocurrency to experience significant movement was bitcoin cash, whose share increased from 5.8% last week to 6.2% today.