It’s Impossible to Kill Bitcoin, Says Former Chief of Govt-Owned Bank of China

Editor’s note: The article’s headline and content have been edited to reflect that L H Li is the former president of the Bank of China, contrary to the original erroneous report that claimed him to be the former governor of the People’s Bank of China. Apologies for the misinformation.

L H Li, former president of the state-owned Bank of China (the fifth-largest bank in the world) and a member of the Financial & Economic Committee at China’s People’s Congress, stated in an interview for CCTV, China’s predominant state broadcaster, that it’s impossible to kill bitcoin. According to a translation by Eric Zhao from the Chinese Academy of Science, Li says :

“Bitcoin was built on a platform without national boundaries. If you want to kill bitcoin, it will be an impossible task. So, it will continue to exist. What’s important now is that we should properly regulate it.”

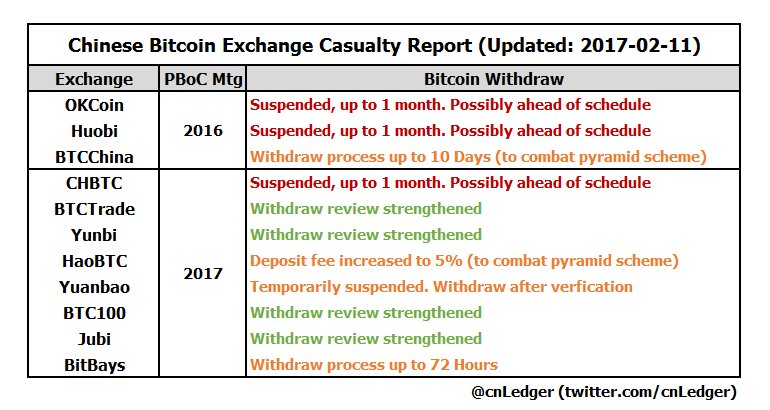

The comments are made after more than a month of PBoC intervention in the bitcoin space, beginning with the opening of an investigation in January. Leading to sweeping changes with many bitcoin exchanges in China implementing fees, withdrawing margins and futures, as well as freezing BTC, LTC and in some cases ETH withdrawals for a time estimate of one month.

China’s Central Bank has communicated very little, giving no direct indication of their plans, leading to many complaints and even anger directed at PBoC. But, we are beginning to gain some clarity as the former governor says that an outright ban is not on the table and that PBoC’s aim is to regulate exchanges.

Regulation or Nationalization?

It remains unclear how exactly exchanges will be regulated with two likely options, covert nationalization through a “third party custodian” scheme, or at arms-lengths regulations which leaves exchanges free to conduct their businesses as long as they fully apply the law. In particular, as long as they enforce foreign exchange rules, co-operate with taxation authorities, guard against money laundering and apply a strict AML process.

There might be some indications that a covert nationalization is on the table as the sudden freezing of withdrawals is unprecedented. Moreover, it is unlikely it was necessary for the stated purpose – namely to upgrade the system for stricter AML requirements.

There were reports of specific accounts being frozen many hours before withdrawals were stopped for everyone. Suggesting exchanges were able to identify potentially unscrupulous accounts, making the exercise of withholding everyone’s digital currency potentially unnecessary.

But, a withdrawals freeze would probably be necessary if a “third party custodian” scheme is to be implemented as the digital currency would have to move from cold storage. During that transition period, withdrawing digital currency would probably be difficult, if at all possible.

We have received no commentary on whether that is or is not the case. Many exchange operators have been reached, but they are unwilling to comment on or off record. As such, we continue to be left in the dark, primarily by PBoC which has not yet fully clarified their plans.

Bitcoin Beginning to Gain Global Regulatory Certainty

Although the former governor’s comments might remove some uncertainty as the freezing of withdrawals is always a worrying event, it does little to indicate how PBoC may regulate exchanges. Are they to require a license, for example? Will extra regulations be applied to bitcoin exchanges specifically? Will regulations affect matters that objectively have no bearing on the law, such as fee requirements?

We do not know, but it now appears clear bitcoin is maturing with a global understanding that the digital currency cannot be shut down, leaving regulations and its incorporation into the financial system as the only choice.

A former US prosecutor stated last year that the US government realized in 2013 bitcoin cannot be shut down. A member of China’s People’s Congress is now stating the same. This may indicate there has been a global change in attitude towards the currency with governments now potentially treating bitcoin businesses as an asset that should perhaps even be encouraged – as long as they fully comply with the law.

Following this added certainty, financial institutions and hedge funds might begin to further diversify as bitcoin trading becomes a regulated activity.

Hat tip to cnLedger .

Image from Shutterstock.