Monero Price Just Pierced $100: Here’s What’s Fueling This Record Rally

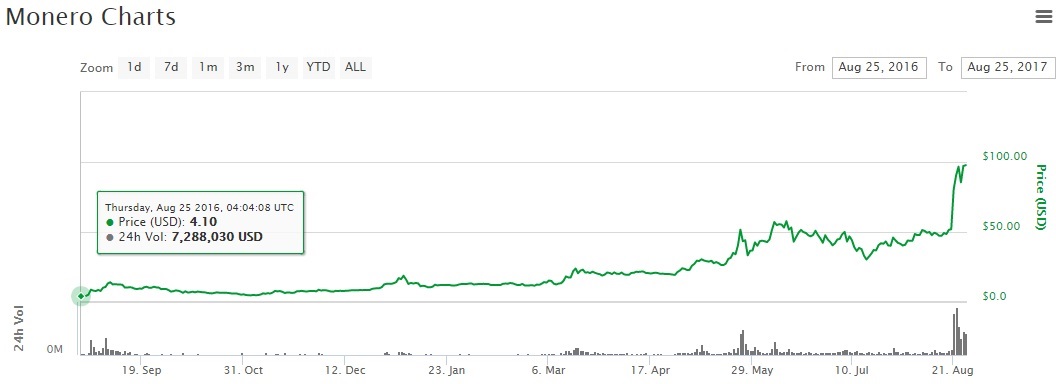

The Monero price set a new record on Friday, piercing the $100 threshold for the first time in its three-year history. This marked another important milestone for privacy-centric Monero, which has been on a year-long bull run that began when the now-defunct darknet market AlphaBay began accepting it as payment in August 2016.

Like all coins, XMR has benefited from the general upswing in the markets, but it has also managed to increase its value against bitcoin, its largest trading pair

One year ago, the Monero price was just $4.10. It broke $10 in December and had doubled to $20 by March. When the markets began to go wild in April, May, and June, the XMR price punched through $50. The market downturn forced the Monero price down to the mid-$30s in July, but August has brought a resurgence.

During the month’s first three weeks, Monero mostly tracked the wider market movement, rising to $54 on August 21. However, it broke from the pack on August 21, spiking above $90 in less than 24 hours.

Bithumb Listing Raises Monero Price to $100

The primary factor influencing this rapid advance was the announcement that Bithumb, the world’s highest-volume cryptocurrency exchange, had decided to list Monero to its platform. This move will enable Monero to break into the lucrative South Korean markets and gives XMR its first KRW trading pair.

On August 25, Bithumb began accepting XMR deposits, and the Monero price jumped to a new all-time high of $101.

Other Factors

The primary factor influencing XMR price movement is the Bithumb listing, but there have been two other factors that could be buttressing the coin’s rally. First, the Hong Kong-based LocalMonero.co launched to provide the community with a peer-to-peer exchange platform similar to LocalBitcoins.com.

Second, news broke this week that the U.S. Internal Revenue Service has been contracting with a blockchain analysis firm since 2015 to track and unmask U.S. residents who they believe are not paying taxes on bitcoin-related income or are using bitcoin to hide assets from the government. News like this could drive the privacy-conscious toward anonymity-centric altcoins such as Monero, Dash, and Zcash.

Featured image from Shutterstock.