New Decentralized Trust Finance

We are living in times of deep economic uncertainty. Eroded trust in official institutions and a sense that centralization of decision-making is less capable of satisfying the wider needs of Society is strong. It shouldn’t be a surprise that a wish to try to test alternatives would grow over time. I think that is what is happening with crytpocurrencies.

We are living in times of deep economic uncertainty. Eroded trust in official institutions and a sense that centralization of decision-making is less capable of satisfying the wider needs of Society is strong. It shouldn’t be a surprise that a wish to try to test alternatives would grow over time. I think that is what is happening with crytpocurrencies.

Cryptocurrencies may well be a successful structure of decentralization of trust (decentralized trust). Trust has been undeniably a cornerstone of economic and financial systems throughout History. But if we look with impartial analytic eye we can see also that the discovery of trust in economic systems follow cyclical patterns, largely responsible for Business Cycle economic theories.

The Blockchain technology supporting Bitcoin is such decentralized ledger, storing, and registering the transactions in the Digital Currency in ways anonymously. Satoshi Nakamoto in the paper that launched Bitcoin explicitly stated that the currency would be a ‘distributed decentralized trust’ value creating way of using the Internet.

Around the world, the number of people who lost its access to Banking and financial services has risen since the 2008 Financial Crisis. And obviously a reaction would inevitably follow, for the potential for entrepreneurship and businesses to grow remained the same. Developments like cryptocurrencies are just helping to fill the void of financing small and medium businesses. That appears to be a good way to bypass the old fear and aversion to risk that follow after a major event as that of 2008. But what are we talking about when we say decentralized trust?

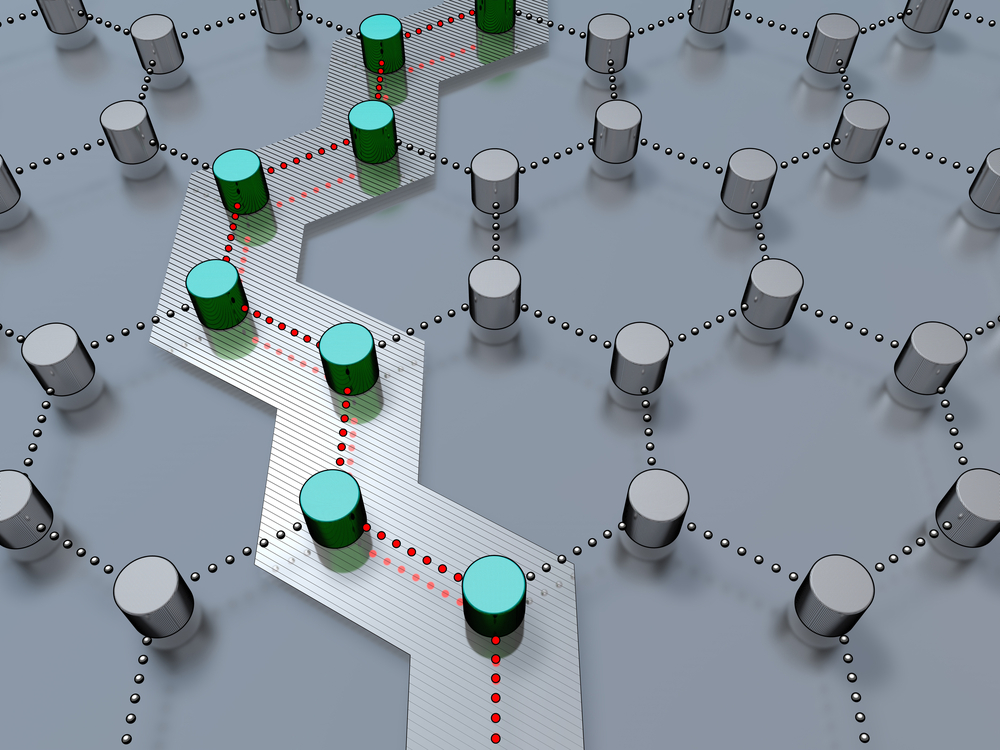

Networked Decentralized Trust

Typically in centralized financial systems a hierarchical outer authority mediates trust. These systems discourage the establishment of two agents peer-to-peer relations of trust. Crytpocurrencies and the blockchain technology fundamentally allows for a peer-to-peer network of agents to emerge and establish the foundation for decentralized trust based economic and financial systems. With a smartphone or a laptop anyone can start their own money system or personalized banking. Of course, what we do is abide by an algorithmic consensus, replacing this by the need for trust. In return, we help create a society based on trust in ourselves and our fellows.

Silicon Valley tech entrepreneur Andreas Antonopoulos describes best Bitcoin security model: ”trust by computation”:

“Trust does not depend on excluding bad actors as they cannot ‘fake’ trust. They cannot pretend to be a trusted party as there is none. They cannot steal the central keys as there is none. They cannot pull the levers of control at the core of the system as there is no core and no levers of control.”

Money and Credit for the Under Banked

In the called developed countries, bitcoin is still viewed as a sideline phenomena. No surprises giving that many rely in their official network of secured financing. But in undeveloped and emerging countries the story is very different.

Bitcoin is becoming a financing alternative and quick way to access monetary liberation. These are people under banked or even completely excluded from the Banking systems of their countries as the officials of these countries implement austerity measures in response to the economic crisis. Even in European countries part of the euro zone like Cyprus, where the financial crisis in 2012 unleashed a major run on banks, many saw in Bitcoin a possible haven where to protect their savings.

A similar pattern emerged in Argentina. The local currency, the peso has seen steep depreciation since 2002, and many resorted to Bitcoins as a safe harbour where to anchor hard-won thrift money. And the trend isn’t stopping yet.

Internet for the Many: the Key

While the developments described above are all happening with increased speed, the reality in many places is not that bright. We need to acknowledge that access to the Internet is still a rich country phenomenon. The key to a Digital future for financial services and cryptocurrencies will largely depend on the Internet becoming available to more and more people in developing countries.

For instance, the payments network Paypal are still blocked in many developing countries. A lot of workers from these countries use remittances to send money to their families. Bitcoin, in conjunction with Paypal or other operators, could well replace remittance companies that usually charge high fees for the service. Digital currencies are cheaper and faster.

The potential for Bitcoin to disrupt the payments environments is indisputable. Recently in a CCN.com post:

In a recent video released by software engineer James Poole, the demonstration of micropayment channels shows how Bitcoin is used for transactions in amounts as small as a fraction of a penny. In fact, micropayment channels can make microtransactions denominated in satoshis much more practical in the real world. With a micropayments channel, a Bitcoin user can set up a trustless environment with a server that allows them to send multiple payments without broadcasting each transaction on the Bitcoin network.

The current methods for handling nano transactions (transactions at a fraction of a second) are all centralized. Micropayments channels solve this by creating a decentralized trust environment where the client and server create a multi-sig agreement in place of giving the central server complete control over user’s account balance and transaction details.

Is centralized decision-making capable of satisfying the wider needs of society? Comment below!

Images from spelunk.in and Shutterstock.