How New York Regulatory Oversight Further Boosts Ethereum

When the Gemini Trust Company begins trading Ether Monday at 9:30 a.m., offering ETH/BTC and ETH/USD trading pairs on two order books, a new chapter begins with the world’s first licensed Ether exchange. Ether is the crypto-asset and token of the Ethereum network, and has emerged as the leading altcoin and is the fastest growing digital currency.

Gemini founders Tyler and Cameron Winklevoss planned from their company’s beginning two years ago to provide a platform to allow customers to trade digital assets in addition to bitcoin. Over the past six months, Gemini recognized Ether as a credible candidate for inclusion on its exchange, according to Cameron Winklevoss, company president, on a Gemini blog . Gemini allows customers the same security for Ether storage that it offers for bitcoin.

Why Gemini Chose Ethereum

The Ethereum protocol’s unique features have delivered a wide range of applications, in addition to a growing market capitalization and liquidity, Winklevoss noted.

The New York State Department of Financial Services (NYSDFS) has become the first regulatory agency in the world to supervise Ether. Regulatory oversight and certainty are important for supporting innovation and protecting consumers, Winklevoss further noted.

“We at Gemini are proud to be supporting this new and incredible technology, and contributing to the next generation economy.”

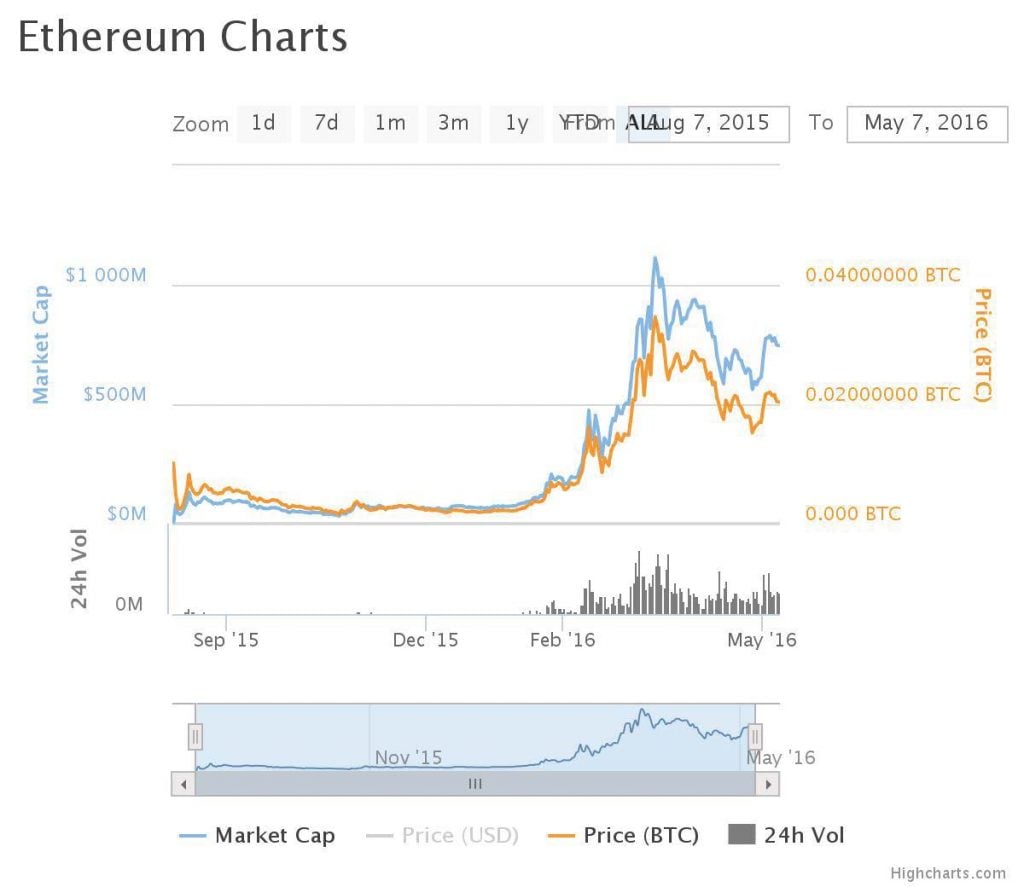

Ether’s market cap soared past $1 billion in March. At this May 7 report, the ETH market cap was $740,492,634 and the price was $9.3659679.

Also read: The mainstream media think bitcoin and ether are competitors

Ethereum Keeps Moving Ahead

As Ethereum grows, it earns media coverage which in turn fuels its growth. The New York Times recently ran a feature story noting its value has spiraled 1,000% in three months and is attracting interest from major financial companies that are using it for private blockchains and smart contracts, CCN.com reported.

Uphold, a platform that provides various financial services and encourages fintech innovation, announced last month it will support Ethereum along with Litecoin to give users more ways to utilize new and disruptive applications. Uphold noted it would launch Ethereum in May.

Uphold decided to support the two cryptocurrencies due to their expanding popularity among developers, financial traders and open source enthusiasts.

Ethereum Spawns Innovation

Coinimal, a Vienna, Austrian-based crypto broker that first offered its users the chance to buy Ethereum in August, has introduced a “sell” feature to enable users to convert their ETH back to fiat, the company noted on its website.

The new Coinimal feature is intended as an easy way to buy and sell the alternative currency using a bank account. Coinimal has nine funding options and withdrawals using PayPal, NETELLER, Skrill or SEPA transfer.

Gemini launched in October 2015 after gaining a charter to operate as a virtual currency exchange without the need for a BitLicense while regulated as a fiduciary, granting it the means to service both individual and institutional clients, CCN.com reported. Gemini is also exempt from registering with the Financial Crimes Enforcement Network, being a state-chartered limited purpose trust company.

Featured image from Imgur.