NFC-Equipped Shake App Allows Users to Spend Bitcoin at VISA Card Terminals

Shake Alpha, based in Montreal, Canada, is a mobile app that allows users to tap and pay with bitcoin at contactless terminals that accept VISA cards, according to the company’s blog .

It is an Android app equipped with near field communication (NFC). NFC allows a phone to emulate the interaction between a terminal and a card. There is also a web app that displays a virtual card to make purchases online.

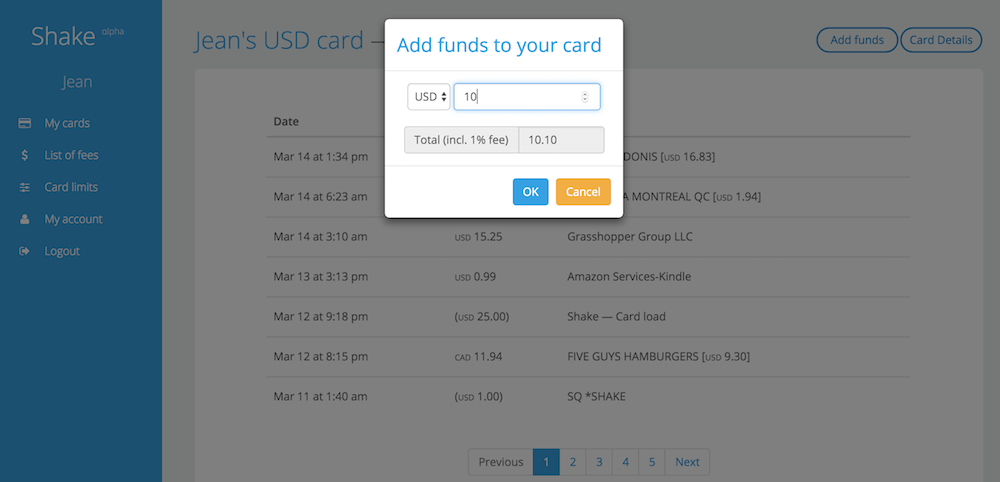

An iOS version is scheduled for mid-April. The company is currently issuing USD and EUR denominated cards. Bitcoin-to-fiat conversion incurs a 1% fee. There is also a 3% fee on foreign transactions.

All contactless-enabled terminals will accept the phone as a payment method.

NFC Apps Integrate Shake

Most Android apps equipped with NFC will integrate Shake. The Shake website offers a list of phone specs so users can see if their phone will work with Shake.

The company is providing the apps on an invite-only basis at present. Interested parties can email the company to join the list.

There is no cost to create the first card and no monthly fee. According to the website, a payment requires six confirmations.

Shake uses Bitpay’s Bitcoin Best Bid Rate to calculate the bitcoin exchange rate.

Bitcoin: More Control Of Funds

Bitcoin and other digital currencies give users more control their funds than banks or credit cards, Shake claims.

By linking bitcoin with the existing financial infrastructure of banks and credit cards, Shake offers consumers benefits. Funds are always in the consumer’s possession until the moment they make a transaction.

Shake also allows users to spend like local consumers in more than 80 currencies. Shake calculates the exchange rate in real time and charges nothing for the exchange.

In situations where plastic cards are not available, a plastic EMV card can act as an alternative to a swipe or chip card. Some new plastic cards have a contactless chip that allows the user to tap on a terminal to process a transaction.

All Shake cards can be used for online payments.

Also read: An interview with the makers of Plutus, a payment app for the BTC adopter

Safety And Money Management

Users can order multiple cards as a safety measure. The user can issue a card number for every merchant he or she does business with. There can be one for Amazon, one for Netflix, and one for daily expenses. If a merchant is hacked, the Shake user can issue a new card, move funds to the new card and be protected against fraudulent charges.

The user can also set rules for transaction authorization. A mobile provider card, for example, can be used for a specific amount on a specific day of the month while a grocery card can have a weekly limit.

On the first signup, Shake collects information from users before issuing a card. This is to comply with anti-money laundering rules.

Spending limits are: one-time purchase, level 1: 2,500 USD, 2,500 EUR; level 2: $10,000 USD, 10,000 EUR. The same limits apply to daily purchases. Users can load the cards twice per day for level 1 and five times per day for level 2.

Users that want to extend their spending limits can upgrade their account by providing a photo ID and proof of address.

The company is exploring accepting other digital currencies.

Issued To Over 130 Countries

During the Alpha, Shake is issuing to more than 130 countries, but not the U.S. The company notes on its website that it is hoping to make it available in the U.S. by the summer of 2016.

Countries that Shake is issuing to include: Åland Islands, Albania, Andorra, Anguilla, Antigua and Barbuda, Argentina, Armenia, Aruba, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Barbados, Belarus, Belgium, Belize, Bermuda, Bhutan, Bonaire, Sint Eustatius and Saba, Bosnia and Herzegovina, Brazil, Brunei Darussalam, Bulgaria, Canada, Cayman Islands, Chile, China, Cuba, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Denmark, Dominica, Dominican Republic, Ecuador, El Salvador, Estonia, Falkland Islands, Faroe Islands, Finland, France, French Guiana, Georgia, Germany, Gibraltar, Greece, Greenland, Grenada, Guadeloupe, Guatemala, Guernsey, Guyana, Hong Kong, Hungary, Iceland, Indonesia, Ireland, Isle of Man, Israel, Italy, Jamaica, Japan, Jersey, Jordan, Kazakhstan, Korea, Republic of, Kosovo, Kuwait, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, The Former Yugoslav Republic of, Malaysia, Maldives, Malta, Martinique, Mauritius, Mexico, Moldova, Republic of, Monaco, Mongolia, Montenegro, Morocco, Nepal, Netherlands, New Zealand, Nicaragua, Norway, Oman, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russian Federation, Saint Barthélemy, Saint Kitts and Nevis, Saint Lucia, Saint Martin (French part), Saint Vincent and the Grenadines, San Marino, Saudi Arabia, Serbia, Seychelles, Singapore, Sint Maarten (Dutch part), Slovakia, Slovenia, Solomon Islands, South Africa, Spain, Suriname, Sweden, Switzerland, Taiwan, Thailand, Trinidad and Tobago, Turkey, Turks and Caicos Islands, Ukraine, United Arab Emirates, United Kingdom, Uruguay, and (British) Virgin Islands.