Terrible Tuesday: Crypto Market Losses Top $25 Billion as Bitcoin & Ethereum Bleed

The cryptocurrency markets continued their downward trend Tuesday following yesterday’s “Monday Massacre.” The total market cap of all cryptocurrencies has fallen by more than $25 billion since peaking at $117 billion in mid-June. Once again, bitcoin and ethereum are leading the retreat, and the altcoins are marching behind, lining up in formation.

To make matters worse, both Coinbase and GDAX halted trading during Monday’s frenzy, infuriating investors who were hoping to use the downturn as an opportunity to purchase coins at what they viewed as a discount.

Bitcoin Price Continues to Fall

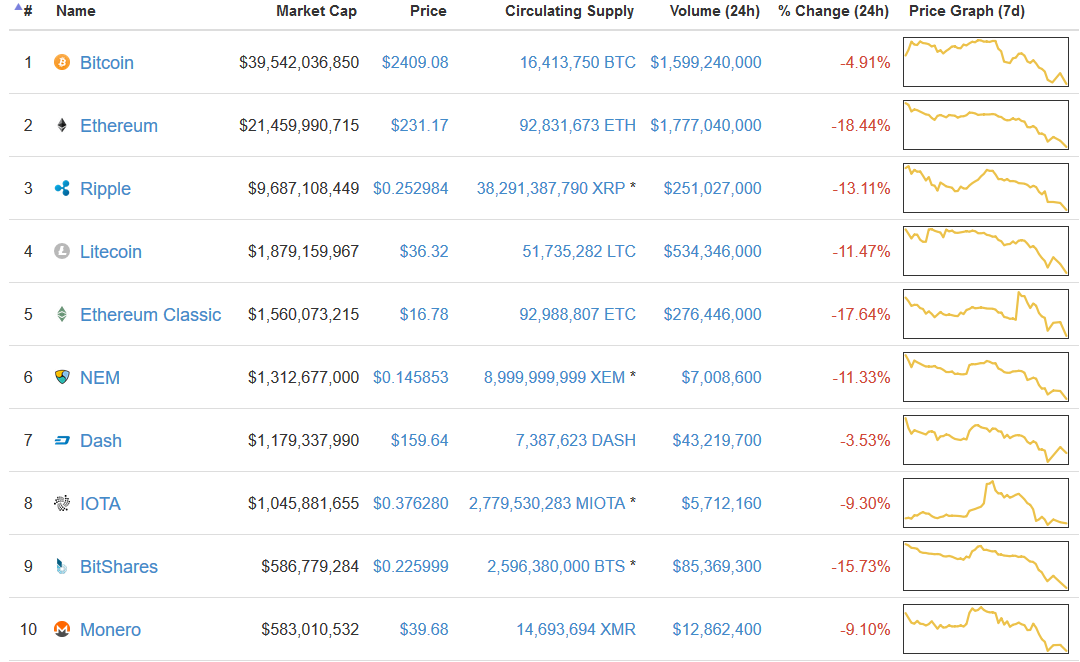

Bitcoin has not been hit as hard as altcoins during this market correction, but it has still decreased considerably. As recently as June 21, the bitcoin price was $2750, but it has declined steadily over the week. On Monday, bitcoin fell below the $2400 barrier to $2370. It climbed back past $2400, but the chart is still not pretty. At present, the bitcoin price sits at $2409, representing a 24-hour decline of 4.9%

Bitcoin’s market cap has now dropped below $40 billion for the first time since the beginning of June.

Bitcoin’s market cap has now dropped below $40 billion for the first time since the beginning of June.

Market Downturn Delays Flippening

Once again, the downturn clobbered ethereum. After peaking at $391 in mid-June, the ethereum price has dropped more than 40%. In the past day alone, ethereum plummeted 18.4% to its present value of $231. Ethereum’s volatility was worsened by the false rumor that co-founder Vitalik Buterin had died in a car crash. Buterin, true to form, used the Ethereum blockchain to prove he was still alive.

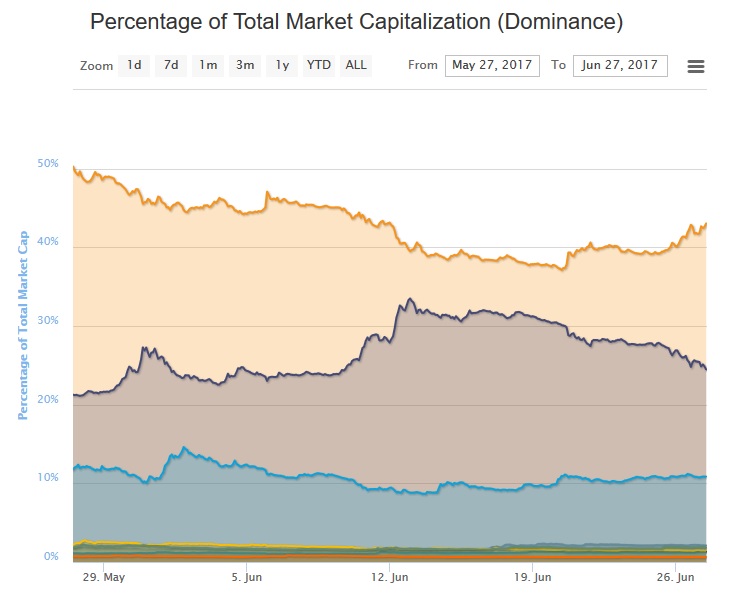

As a result of the market correction, short-term Flippening prospects are looking decreasingly likely. As the below chart indicates, ethereum has lost ground during the downturn. Bitcoin now has a 43.7% dominance of total cryptocurrency market cap, regaining some of the ground it lost during the mid-June market surge.

Ethereum now controls 24.5% of the total market cap, and Ripple maintains an 11% market share.

Altcoins Continue to Bleed

Yesterday, 92 of the top 100 cryptocurrencies experienced price decreases. They continued that trend on Tuesday, as 91 of the top 100 continued to fall. Ripple fell 13% to $0.253, dropping its market cap below $10 billion. Ethereum Classic has been unable to take advantage of Ethereum’s recent struggles; ETC has fallen more than $5 in the past week to $16.78. The BitShares price has fallen by a third in the past 7 days to $.225.

Most altcoins outside of the top ten have seen double-digit decreases for the second consecutive day. CloakCoin, the only top-100 altcoin to make significant gains yesterday, has fallen by 32% as investors have dumped the coins at a profit. AntShares, the 19th-ranked cryptocurrency, was the only bright spot for the cryptocurrency markets. In the past 24 hours, it saw a 25% price increase to $5.91. Nevertheless, the AntShares price has still dropped 40% in the past week.

Don’t Panic

Market corrections always spark doom and gloom predictions and analysis, but as one CCN.com commenter stated yesterday, “Scared money don’t make money.” The investors who lost money during the Great Recession were the ones who cashed out during the market panic, not the ones who held on to their investments and trusted in a future market recovery. In fact, those who bought into the dip made incredible short-term gains. The same has been true of bitcoin investors who have chosen to ride the dips rather than buying high and selling low. Now, as then, investors must avoid making rash, emotional decisions and proceed calmly and rationally.

As P.H. Madore wrote yesterday:

The historical charts show it’s more likely that things will rebound than not, so perhaps take some solace in that. Or just back out until you are comfortable with your hodlings again, thereby forfeiting later profits. The beauty part is, it’s all up to you. So chin up. Everyone’s still standing, everyone’s still whole. All that really happened today was some newcomers and bull traders got discount coins.