Wall Street Shows $60 Million Interest In Bitcoin

The US stock market traded higher on Thursday despite a disappointing open for the Dow. | Source: Shutterstock

As previously reported, the Bitcoin Investment Trust recently became the first publicly invested hedge fund which is specifically and exclusively working with Bitcoin, tying its own value to the market price of Bitcoin. Having initially begun publicly trading last week, the Trust which services individuals making over $200,000 per year or having assets greater than $1 million has now filed its Form D, which is an exemption from having to file with the Securities and Exchange Commission based on certain criteria.

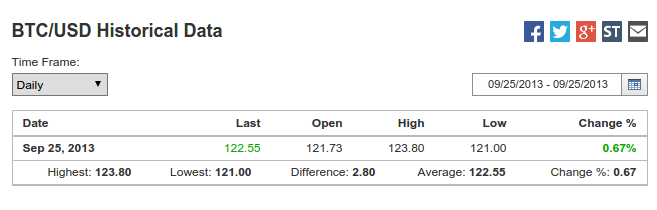

Their Form D filing states that they have raised over $60 million – $61,915,960 to be exact – since September 25th, 2013. For perspective, on 9/25/13, the average price of bitcoin was a mere $122.55. Since then it has seen the heights of well over $1000 and has dropped and dropped harder on negative news from Mt. Gox and countless other scandals.

Will the BIT Bring New Stability to Bitcoin?

Since the news of BIT going public as a traded security, the fiat value has risen by small increments, the steady kind of rise that both investors and hoarders like to see. Unfortunately, the form does not require the firm to disclose what the largest investments were, but breaking down the numbers it does give us we can draw a conclusion that the average investment is $324,167.33. This is because the form reports 191 investors and the aforementioned total.

However, the form also tells us that the minimum investment is $25,000. So there are some other possible scenarios. One such other possible scenario is that the 90% of the investors only invested the minimum in this new, unknown-to-them market. For ease of understanding, let’s call it an even 19 that invested more than the minimum. 90% investing $25,000 leaves $57,615,960 spread over the remaining 19 individuals. Those individuals would have invested an average of $3,032,418.90 each.

In reality, the numbers probably vary a great deal more than this, and the wealthy are notoriously (and perhaps for good reason) private about their investments and holdings.

Another notable feature of this form is section 16, “Use of Proceeds,” which lists that none of the money “has been or is proposed to be used for payments to any of the persons required to be named as executive officers, directors or promoters.”

Not quite six years on, Bitcoin has gone from the fringe idea of some cypherpunks and libertarians to a viable, publicly-traded hedging asset coveted by major Wall Street players. At this point, some would argue that it is incomparable with anything else which has striven to do the same thing.